Beneficiary ira rmd calculator

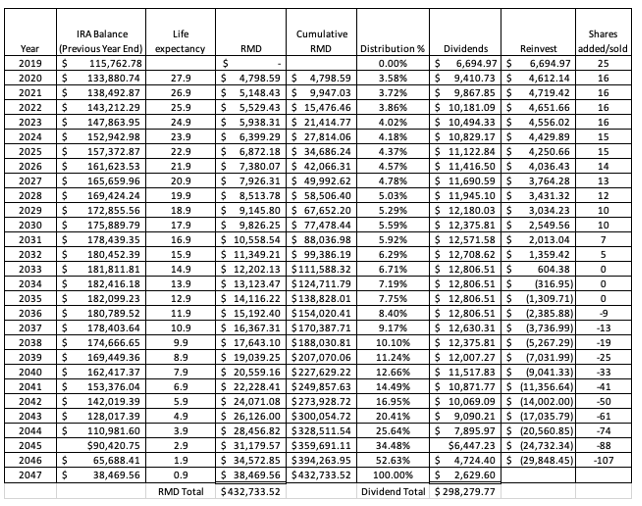

You may designate your own IRA beneficiary. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Open an Inherited IRA.

. For 2022 I was expecting to use 285 as the divisor. Inherited IRA beneficiary tool. You must begin taking RMDs from a traditional IRA by April 1 of the year after you turn 72 the old threshold of 70½ still applies if you hit that age by Jan.

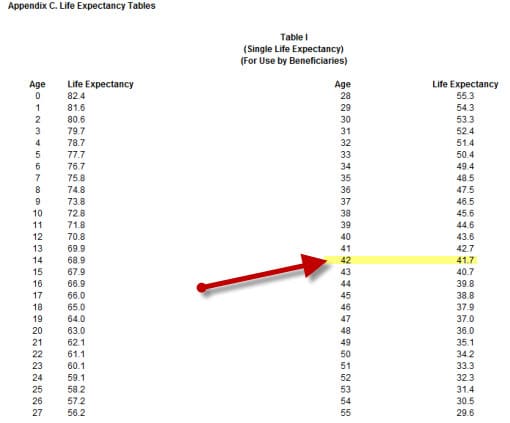

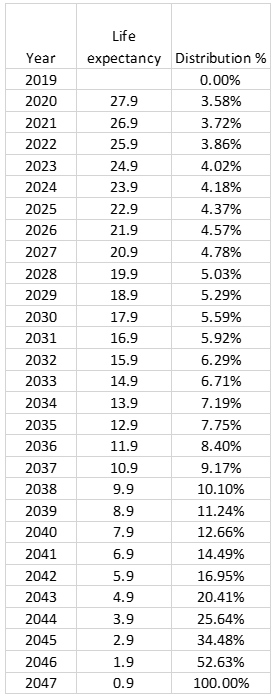

In this case RMDs start when the surviving spouse reaches age 72. Act as a beneficiary. Calculate the required minimum distribution from an inherited IRA.

Required Minimum Distribution - RMD. Naming a grandchild as an IRA beneficiary can be a tax-smart way to pass on moneyboth for you and for your grandkids. In some situations the RMD rules for beneficiaries of IRA owners who died before 2020 are different than the RMD rules for beneficiaries of IRA owners who dies in 2020 and beyond.

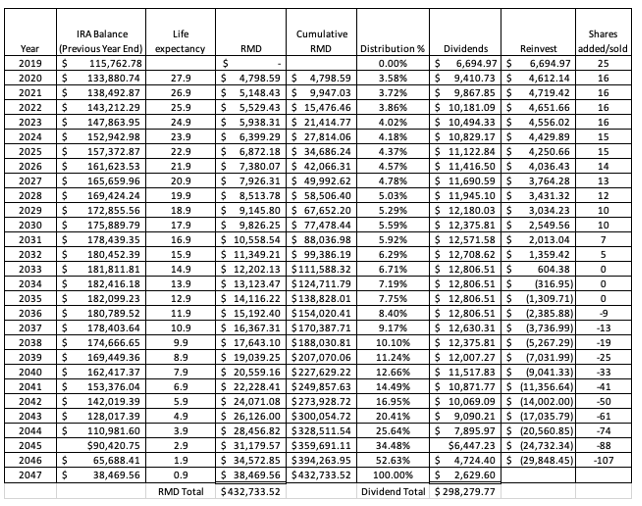

RMD amounts depend on various factors such as the. How the IRA Withdrawal Calculator Works. The CARES Act of 2020 provided a temporary waiver of RMDs.

Use this calculator to determine your required minimum distributions RMD from a traditional IRA. The custodian of my account is telling. This way you can take the late RMD see.

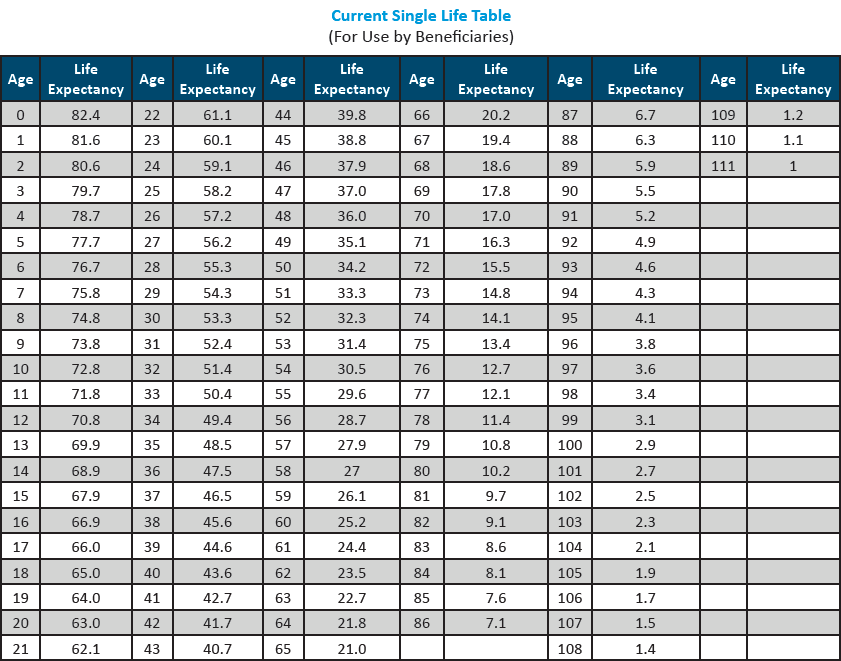

RMD for Roth IRAs unlike those required for traditional IRAs or 401ks. Over his or her. I deferred taking an RMD in 2020 and I took an RMD in 2021 using 295 as the life expectancy divisor.

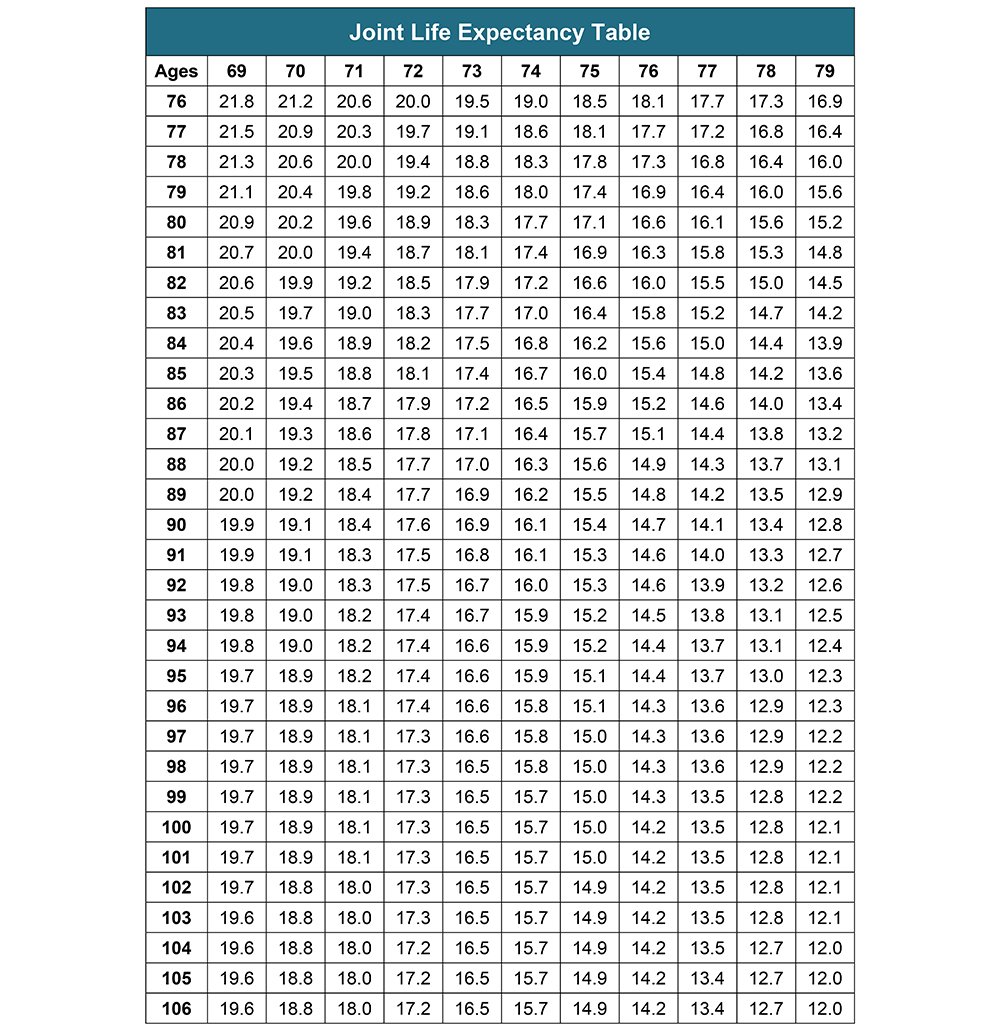

Plus review your projected RMDs over 10 years and over your lifetime. This tax information is not intended to be a substitute for specific individualized tax. If your spouse is the sole beneficiary and is more than ten years younger than you you must use Table II.

That amount is called a required minimum distribution RMD. If the beneficiary is the spouse of the owner the spouse can also choose to treat the IRA as his or her own Therefore if the distribution is from a qualified plan the beneficiary should contact the plan administrator. When a beneficiary becomes entitled to an IRA from an account owner who died before he or she was required to begin taking RMDs April 1st of the year following the year in which the owner reached RMD age the beneficiary can choose one of two methods of distribution.

All other IRA rulesincluding early-withdrawal penaltiesstill apply. If you havent by this point be sure to do so before you file. If your spouse is the sole beneficiary and is more than ten years younger than you you will use Table II.

Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. Roth IRAs are the only tax-sheltered. If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much you may be required to withdraw this year from the inherited account.

For example a 40-year-old non-spouse beneficiary who inherited a 1 million traditional IRA when the stretch option was allowed would have been required to withdraw a 23000 RMD the first year. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator. But as you can see the devil is in the details so.

Compare Investments and Savings Accounts INVESTMENTS. For an inherited IRA received from a decedent who passed away before January 1 2020. The CARES act temporarily waives RMDs for all types of retirement plans for calendar year 2020.

Use our RMD calculator to find out the required minimum distribution for your IRA. The options for the RMD pay-out period may be as short as 5 years or as long as the life expectancy of the beneficiary. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July.

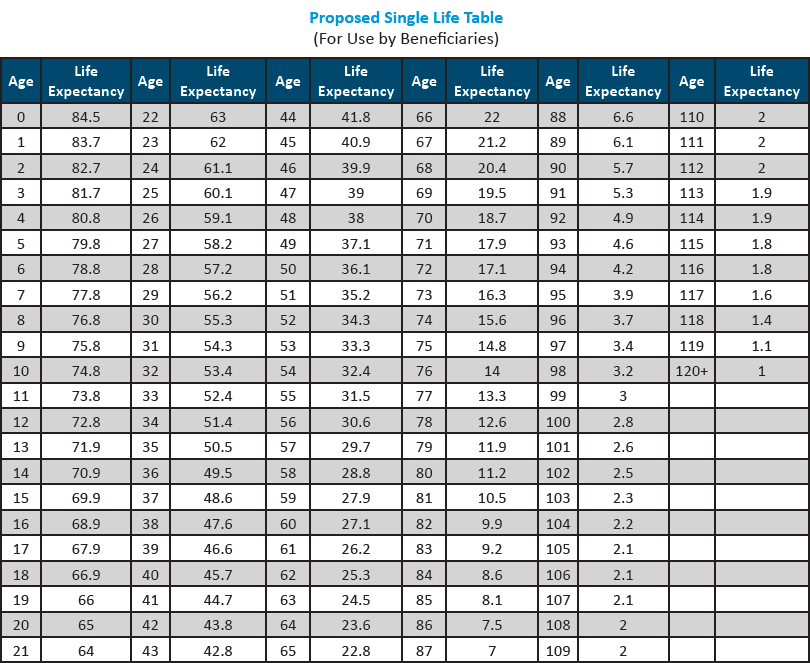

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single life expectancy table. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

Which means you can distribute the assets. A required minimum distribution RMD is the amount that traditional SEP or SIMPLE IRA owners and qualified plan participants must begin distributing from. If you are not an eligible designated beneficiary or you inherited the IRA after 12312019 you fall under the new 10-year distribution rules.

The RMD waiver is for retirement plans and accounts for 2020. Use our Beneficiary RMD calculator This tax information. Note that the minimum is different for spouses and non-spouse beneficiaries.

B y the time youre filing the exemption request you want to have already contacted your IRA custodian. The IRA RMD calculator is based on Table II Joint Life and Last Survivor Expectancy and Table III Uniform Lifetime Table from IRS Publication 590-B 2021 opens new window. If you inherited an IRA from your spouse you have the choice of either moving the money into your own IRA or into an inherited IRA.

This includes the first RMD which individuals may have delayed from 2019 until April 1 2020. RMD each yearas long as all assets are distributed within 10 years of your death. This includes direct contribution plans such as 401k 403b 457b plans and IRAs.

Ready to run some numbers. Roll the account over into their own IRA within 60 days. The RMD rules are different for each choice so consider your options carefully.

Start here with the Inherited IRA calculator or if applicable jump to the Traditional IRA calculator. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value. Assumes that beneficiary has transferred the inherited assets.

To pay the beneficiary after the death of the account holder. Inherited IRA RMD Calculator. The IRA Withdrawal Calculator is based on Table II Joint Life and Last Survivor Expectancy and Table III Uniform Lifetime Table from IRS Publication 590-B 2021 opens new window.

Additional RMD required for beneficiary 1 due to delay in separating accounts in a timely manner. RMD rules apply to tax-deferred retirement accounts. To determine what your withdrawal options might be select the Identify Beneficiary Options button below.

This means that as soon as you submit the RMD penalty tax waiver you would be caught up and would have already remedied the. A spouse can decide to remain a beneficiary and the account will become a beneficiary IRA.

Rmd Tables

The Inherited Ira Portfolio Seeking Alpha

Mandatory Ira Withdrawals The Elder Law Firm Of Robert Clofine

Your Search For The New Life Expectancy Tables Is Over Ascensus

Sjcomeup Com Rmd Distribution Table

After Death Required Minimum Distribution Rules After The Secure Act Dbs

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Ira Distributions Tax Pro Plus

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distributions Tax Diversification

The Inherited Ira Portfolio Seeking Alpha

Your Search For The New Life Expectancy Tables Is Over Ascensus

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Required Minimum Distributions Rules Heintzelman Accounting Services

Required Minimum Distribution Calculator

Rmd Tables